Crypto Basics: A Beginner’s Guide to Digital Currency

In recent years, digital currencies have become a popular topic. Understanding the basics of crypto is essential for anyone looking to invest or simply stay informed. This beginner’s guide to digital currency will help you grasp the fundamentals, making it easier to navigate the world of crypto.

What is Cryptocurrency?

Cryptocurrency, often called crypto, is a digital or virtual currency that uses cryptography for security. Unlike traditional currencies, it operates independently of a central authority like a bank. Bitcoin, created in 2009, was the first cryptocurrency and remains the most well-known. Additionally, newer cryptocurrencies like Pepe coins have emerged, offering unique features and communities.

- Digital and Decentralized: Crypto exists only online and is not controlled by any single entity.

- Secure: Cryptography makes it nearly impossible to counterfeit or double-spend.

How Does Cryptocurrency Work?

Cryptocurrencies work on technology called blockchain. A blockchain is a distributed ledger that records all transactions across a network of computers. This ensures transparency and security.

- Blockchain Technology: A public ledger that records all transactions.

- Mining: The process by which new coins are created and transactions are verified.

Types of Cryptocurrencies

While Bitcoin is the most famous, thousands of cryptocurrencies exist today. Some of the most notable include Ethereum, Ripple (XRP), and Litecoin. Each has unique features and uses.

- Bitcoin (BTC): The original cryptocurrency.

- Ethereum (ETH): Known for its smart contract functionality.

- Ripple (XRP): Focuses on real-time global payments.

How to Buy Cryptocurrency

Buying cryptocurrency is relatively straightforward. You need to choose a crypto exchange, create an account, and make a purchase using traditional currency or another cryptocurrency.

- Crypto Exchanges: Platforms where you can buy, sell, and trade cryptocurrencies.

- Creating an Account: Typically involves verifying your identity.

- Making a Purchase: Can be done using a bank transfer, credit card, or other cryptocurrencies.

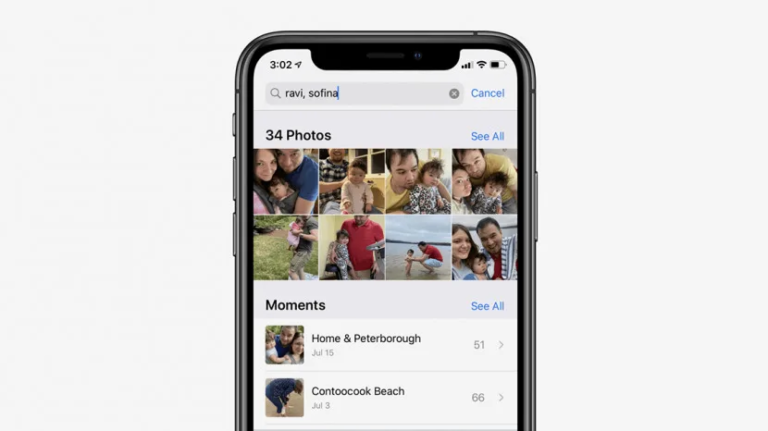

Storing Cryptocurrency

After purchasing crypto, you need a safe place to store it. Crypto wallets come in two main types: hot wallets and cold wallets. Hot wallets are connected to the internet, while cold wallets are offline, offering more security. Check Guide Here: https://upbent.com/fintechzoom-gm-stock/

- Hot Wallets: Convenient for frequent trading.

- Cold Wallets: More secure for long-term storage.

Using Cryptocurrency

Cryptocurrencies can be used for various purposes, including buying goods and services, investing, and sending money across borders. Many companies now accept Bitcoin and other cryptocurrencies as payment, and innovative solutions like the Bybit card are making it even easier to spend digital assets on everyday purchases. This is bridging the gap between the crypto and traditional finance worlds.

- Purchasing Goods: Some retailers accept crypto.

- Investing: Many people buy crypto as a long-term investment.

- Transferring Money: Crypto can be sent to anyone worldwide quickly and with low fees.

Benefits of Cryptocurrency

Cryptocurrency offers several advantages over traditional money systems. It provides increased privacy, lower transaction fees, and faster international transfers. Additionally, it is accessible to anyone with an internet connection.

- Privacy: Transactions can be more private than traditional banking.

- Lower Fees: Typically lower than traditional banking fees.

- Speed: Faster than traditional wire transfers.

Risks of Cryptocurrency

Despite its benefits, cryptocurrency also comes with risks. These include high volatility, regulatory uncertainty, and security concerns. It’s important to be aware of these risks before investing.

- Volatility: Crypto prices can fluctuate wildly.

- Regulation: Uncertain regulatory environments can impact crypto markets.

- Security: While blockchain is secure, exchanges and wallets can be vulnerable to hacks.

Crypto Regulation

Governments worldwide are still figuring out how to regulate cryptocurrencies. Regulations can impact the market, affecting prices and accessibility. Staying informed about regulatory changes is crucial for anyone involved in crypto.

- Regulatory Environment: Varies by country and is constantly evolving.

- Impact on Market: Regulations can influence crypto prices and usage.

Future of Cryptocurrency

The future of cryptocurrency is uncertain but promising. Many experts believe that digital currencies will become more integrated into our daily lives. Innovations like decentralized finance (DeFi) and non-fungible tokens (NFTs) are pushing the boundaries of what is possible with crypto.

- Integration: Increasing acceptance and usage in everyday transactions.

- Innovations: DeFi and NFTs are expanding the use cases for crypto.

Conclusion

Understanding crypto basics is essential for anyone interested in digital currencies. This beginner’s guide to digital currency covers the key points you need to know to get started. From buying and storing crypto to understanding the risks and benefits, this guide provides a solid foundation for navigating the crypto world.

In summary, digital currencies like Bitcoin and Ethereum are transforming the financial landscape. By learning the basics, you can make informed decisions and potentially benefit from this revolutionary technology. Whether you’re looking to invest or simply stay informed, understanding crypto basics is your first step.